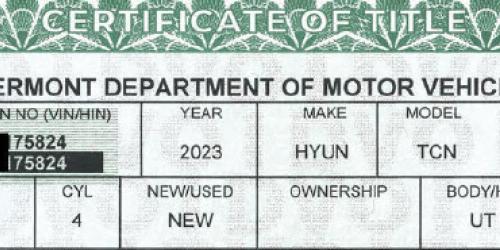

Requirements to Re-title/Register a Vehicle upon Death of Owner

Required Documents

The following documents are required to sell or assign the vehicle based upon the Rights of Survivorship (please note "Exceptions" below):

Vehicle is jointly titled to Tenants By The Entirety (spouses):

- A copy of the Death Certificate identifying the surviving spouse.

Vehicle is jointly titled and title states ownership to be Joint Tenants or Partners:

- A copy of the Death Certificate.

Vehicle titled to deceased only and ownership states Transfer on Death "TOD":

INTESTATE - NO PROBATE

- A copy of the Death Certificate.

- A letter from an officer of the court stating that the deceased died intestate, there is no estate to be probated or the estate need not be probated, and names the person who has the rights of ownership to the vehicle. If the officer of the court is from out-of-state, additional proof is required that the authority is a member of the Bar or a Court Official.

- Original title properly assigned with "Release of Liens" section completed by the lienholder, if applicable.

INTESTATE - PROBATE

- A letter from the Probate Judge naming the Administrator of the estate.

- Original title properly assigned with the "Release of Liens" section completed by the lienholder, if applicable, and Section 1 completed by the Administrator and other owner(s), if they exist, assigning the vehicle to the new owner(s).

WILL - NO PROBATE

- A copy of the Death Certificate.

- A letter from the officer of the court stating the deceased died, leaving a will that was not probated and naming the person with rights of ownership to the vehicle. If the officer of the court is from out-of-state, additional proof is required that the authority is a member of the Bar or a Court Official.

- Original title properly assigned, with "Release of Liens" section completed by the lienholder, if applicable.

WILL - PROBATE

- A letter from the Probate Court showing proof of appointment of Executor of the Will.

- Original title properly assigned with "Release of Liens" section completed by the lienholder, if applicable, and Section 1 completed by the Executor and other owner(s), if they exist, assigning the vehicle to the new owner(s).

Definitions

- Registered/Titled Owner: Individual(s) shown as Owner(s) on the Title and/or Registration Certificate.

- Intestate: Died without a will.

- No Probate: The estate will not be the subject of Probate Court proceedings.

- Probate: The estate is the subject of Probate Court proceedings.

- Officer of the court: An attorney or an official court officer such as a Court Clerk or Probate Judge.

Re-Registering the Vehicle

- Names on the registration and title must be the same; any changes to the names on the registration and/or title must be submitted at the same time.

- If the new owner(s) are not currently registered owner(s), or if the registration has expired, the vehicle must be re-registered. A completed Vermont Registration, Tax, and Title Application must be submitted along with the appropriate fees.

- If the surviving spouse is registering the vehicle, see "Surviving Spouse Exception" below.

Surviving Spouse Exception

Transfer of an interest in Vehicle, ATV, Snowmobile, or Vessel 23 V.S.A. §2023 and §3816.

- This exception applies to a maximum of two vehicles (no limit on vessels, snowmobiles, or all-terrain vehicles).

If there is a third (or subsequent) vehicle involved, the new owner will be required to pay the full fees for the title and registration, and payment of Purchase and Use Tax may apply.

- This exception doesn't apply if the motor vehicle is titled in the name of one or more persons other than the deceased and the surviving spouse.

The surviving spouse may have the vehicle registration/title transferred to his/her name if:

- the deceased spouse died intestate, or

- the person's will or other testamentary document does not specifically address the disposition of motor vehicles.

No fees are due under this exception, allowing a maximum of two vehicles under 23 V.S.A. § 2023 and two vessels/ATV/motorcycles under 23 V.S.A. § 3816. The Vermont Registration, Tax, and Title Application form must be completed. The surviving spouse statement (below) must be completed in order to qualify for transfer at no fee.