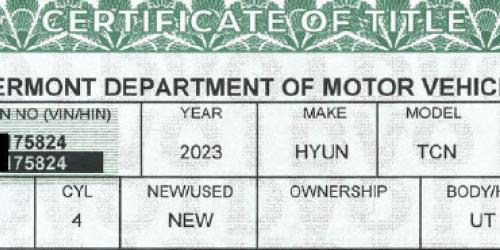

Purchase and Use Tax (32 V.S.A.)

Purchase:

Purchase and Use Tax is due at the time of registration and/or title at the rate of 6% of the purchase price or the J. D. Power clean trade-in value, whichever is greater (see allowable credits and exemptions).

If the vehicle is registered/titled to you or your spouse out-of-state, tax is based on J. D. Power clean trade-in book value and is due unless exempt.

You may submit a Vermont Dealer Appraisal form if the vehicle’s value is less than the J. D. Power value.

Lease:

The dealer or leasing company will calculate the tax. A lease agreement or Vermont Dealer worksheet must be submitted with the documents. If the individual purchases this vehicle at the end of the lease, they will pay tax on the "residual/lease end value" of the vehicle.

The registration application is received from a Vermont Dealer or a Vermont Dealer acting on behalf of the Lessor. A "Purchase and Use Tax Computation - Leased Vehicle" form may be submitted instead of a copy of the lease agreement and dealer worksheet.

Original Acquisition Cost - Lease End Value = Purchase Price

The Purchase Price is the amount that will be taxed.