Registering a used vehicle received as a gift

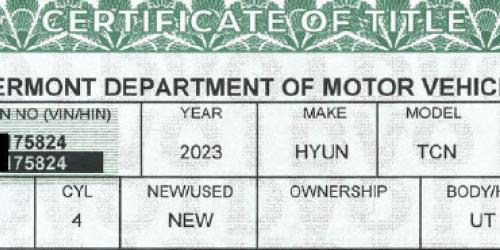

You must provide the original title in the donor's name to qualify for the gift exemption if the vehicle was registered or titled in another jurisdiction/state. If the vehicle was not titleable in the previous jurisdiction, you must provide the original (or a certified copy) of the registration certificate in the donor's name.

If the donor is deceased, provide a copy of the death certificate. The Administrator or Executor must sign the application. The Administrator or Executor must attach court documentation showing that they were assigned as such (a copy of the will is unacceptable).

A motor vehicle may be exempt from taxation if it is a gift or inheritance as defined under 32 VSA §8911 (8).

To qualify for the exemption, the motor vehicle must be registered and/or titled in the name of the original donor and transferred as a gift to a

- Daughter / Daughter-in-Law

- Father / Father-in-Law

- Grandchild

- Grandparent

- Mother / Mother-in-Law

- Sibling / Stepsibling

- Son / Son-in-Law

- Spouse / Ex-Spouse

- Stepdaughter / Stepson

- Stepfather / Stepmother

- A Trust established for the benefit of any such persons

If the transfer involves a divorce, provide a copy of a court document identifying the individuals and indicating the date of the final decree. The donor must have owned the vehicle on the date of the final decree. The transfer must occur within one (1) year after the date the divorce became final.

If the transfer involves a trust, submit copies of the trust documents with this form.

Sale or Trade-In of Vehicles under Gift Tax Exemption. The taxable cost of a vehicle, except a leased vehicle, is the taxable cost less the amount allowed as a trade-in. If the vehicle traded was received as a gift under the gift tax exemption guidelines, it does not need to have been registered by the purchaser of the new vehicle to qualify for the credit. As stated previously, supporting documentation must be included with the application for registration.

A transfer that involves payment of any kind does not qualify. The exemption will be denied if a "Gift Tax Exemption" claim is submitted with a registration or title application that lists a lienholder.

A refund request for the tax paid at the time of registration can be made within one year if proof of eligibility for the gift tax exemption is obtained after the fact.

You must submit the following documents obtained from the person who is giving you the vehicle (the previous owner):

- Properly assigned title*

- Bill of Sale & Odometer Disclosure Statement

- Certification of Tax Exemption

* Proper assignment requires all the owners listed on the title to sign as sellers in the assignment of ownership section on the back of the title, and the new owner’s name must be entered on the “transferred to” line. Any liens listed on the title must be released.